The Vedanta stock or Vedanta Share Price has remained one of the most discussed stocks

in the Indian metal and mining sector. Known for its strong

dividend history or diversified business model or and high

retail participation or Vedanta continues to attract both

long-term investors and short-term traders. In this

article or we will take a detailed look at the Vedanta share price or

its performance on NSE Vedanta or dividend updates including

Hind Zinc dividend or and the latest news Vedanta

investors should know.

Overview of Vedanta Stock

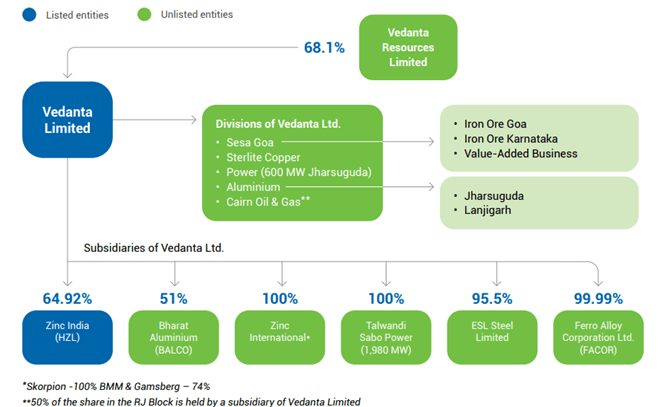

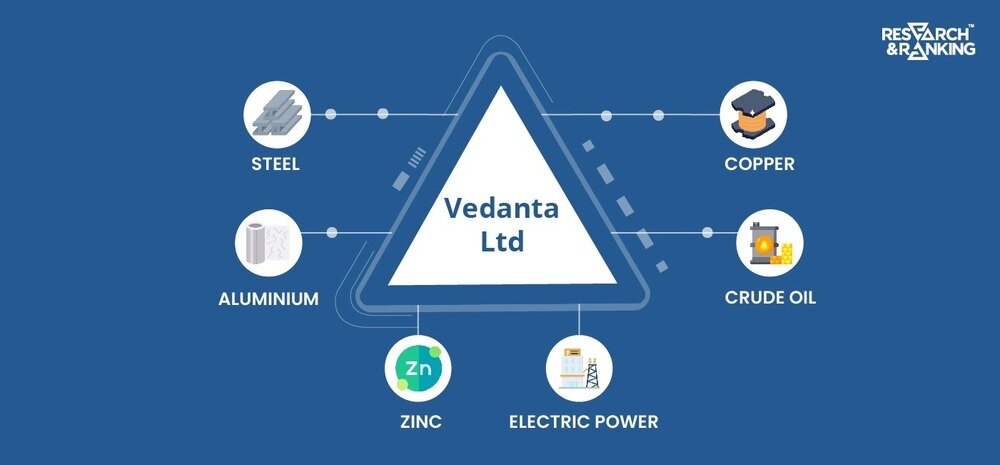

Vedanta Limited is a globally diversified natural resource

company with operations in zinc or aluminium or oil & gas or

iron ore or steel or copper or and power generation. Listed on

Indian stock exchanges or NSE Vedanta is tracked closely

due to its volatility and high dividend yield.

The current share price of Vedanta often reflects

global commodity trends or crude oil prices or and policy

decisions. Because of its exposure to multiple commodities or

Vedanta stock tends to react quickly to international market

movements.

Vedanta Share Price Performance on NSE Vedl

The Vedanta share price on NSE Vedl has seen

sharp ups and downs over the last few years.

While global economic slowdowns have occasionally

pressured metal stocks or Vedanta has managed to

stay relevant due to its cost-efficient operations and

strong cash flows. Retail investors frequently monitor

the current share price of Vedanta for swing trading

opportunities or as the stock often shows wide price

movements within short periods. Analysts usually

consider Vedanta a high-risk or high-reward stock or

especially for investors who understand commodity

cycles.

Factors Affecting the Current Share Price of Vedanta

Several key factors influence the current share price of Vedanta

- Global product prices: – Zinc or aluminium and oil

prices directly impact for a revenues.

- Responsibility levels: – Vedanta’s parent company debt reform

news often disturbs sentiment.

- Extra announcements: – High dividends usually provide

downside support to the stock for Share Price of Vedanta.

- Government policies: – Mining guidelines and export

duties effect earnings.

- Latest news Vedanta releases: – Corporate actions and

restructuring plans play a major role for a Vedanta share.

Because of these factors or news on Vedanta share movements is tracked closely by both recognized and retail investors.

Dividend Strength and Vedanta and Hind Zinc Dividend share price

One of the biggest attractions of Vedanta stock is its dividend-paying

Capability for a share prices. Vedanta has consistently rewarded shareholders or making

it popular among income-focused investors.

Hind Zinc Dividend Contribution

Vedanta holds a majority stake in Hindustan Zinc Limited or which

is also known for generous payouts. The dividend of Hind Zinc

plays a significant role in Vedanta’s cash inflows.

- Hind Zinc dividend declarations often lead to

positive sentiment for Vedanta stock up share prices.

- Strong payouts from Hindustan Zinc help Vedanta

manage debt and fund extras.

- Investors closely track dividend of Hind Zinc as it

indirectly supports Vedanta’s balance sheet.

This dividend linkage is one of the reasons why Vedanta is considered a high-yield stock in the Indian market.

Latest News Vedanta Investors Should Watch

Keeping up with the latest news Vedanta is important for making informed investment decisions.

- Business reformation or separation plans

- Asset sales or achievements

- Debt decreases strategies

- Dividend announcements

- Global metal demand outlook

Any major news on Vedanta share can cause piercing price movements on NSE Vedanta or specially during market hours.

Comparison With Other Popular Stocks

Investors often compare Vedanta with stocks from different

sectors to diversify their portfolios. For example or while Vedanta belongs

to the metal and mining space or healthcare stocks such as Medanta

share price today represent defensive investing.

- Vedanta stock is returning and article of trade driven.

- Medanta share price today reflects growth in the healthcare sector.

This comparison helps investors balance risk by combining cyclical stocks like Vedanta with stable sector stocks.

NSE Vedanta: Technical and Trading Perspective

From a trading viewpoint or NSE Vedanta is known for high

volumes and strong sharing. Traders often use technical

needles such as moving averages or RSI or and volume patterns to

trade the stock.

Short-term traders usually track

- Support and resistance levels

- Breakout zones

- Reaction to latest news Vedanta updates

Because of frequent movement or Vedanta share price is suitable for experienced traders who can manage volatility.

Long-Term Investment Outlook

For long-term investors or Vedanta stock price up of stork presents both opportunities and risks.

- Strong strength base

- High share produce

- Strategic position of metals like zinc and aluminium

On the risk side

- Requirement on service cycles

- Debt concerns at the parent level

- Controlling and environmental challenges

Investors tracking the current share price of Vedanta strategic position of metals like a zinc and aluminium should align their strategy with their risk tolerance and investment horizon.

Should You Invest in Vedanta Stock

Whether or not to invest in Vedanta stock depends on your goals

- Income investors may find the extra harvest attractive.

- Traders may benefit from price volatility on NSE Vedanta stock.

- Conventional investors should be alert due to cyclical risks.

Tracking news on Vedanta share or extra announcements or and the Hind Zinc dividend is critical before making any decision.

For more information Click Here :- Trendswithyou.com contact